Securing a loan often requires borrowers to provide collateral, which serves as a form of security for lenders. Understanding Collateral in Loans

What is Collateral?

Collateral refers to assets or property pledged by a borrower to secure a loan. It acts as a guarantee that the lender can seize and sell to recover their funds if the borrower defaults on the loan. Assets Pledged for Security

Types of Collateral

Common types of collateral include real estate (such as homes or commercial properties), vehicles, equipment, inventory, savings accounts, and valuable personal assets like jewelry or art. Diverse Forms of Collateral

Purpose of Collateral

The primary purpose of collateral is to mitigate the lender’s risk by providing an alternative source of repayment if the borrower fails to meet their obligations. It gives lenders confidence in approving loans, especially for borrowers with less-than-ideal credit histories. Mitigating Lender’s Risk

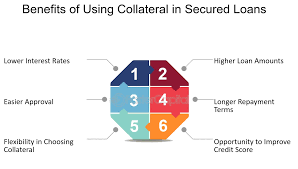

Advantages of Using Collateral

For borrowers, using collateral can lead to lower interest rates and larger loan amounts, as it demonstrates commitment and reduces the lender’s potential losses. Lower Interest Rates and Larger Loan Amounts

Considerations for Borrowers

Borrowers should carefully consider the type and value of collateral they offer, as it directly impacts loan terms and conditions. Defaulting on a loan secured by collateral can result in the loss of pledged assets. Impact on Loan Terms

Lender’s Perspective

From the lender’s viewpoint, collateral provides a layer of protection and increases the likelihood of recovering funds in case of default. However, assessing the value and marketability of collateral is crucial to ensuring adequate security. Protection and Recovery Assurance

Conclusion

In conclusion, collateral plays a vital role in securing loans by providing lenders with reassurance and borrowers with opportunities for favorable terms. Understanding the dynamics of collateralization is essential for both parties involved in the lending process to make informed decisions and mitigate risks effectively. Ensuring Informed Decisions

By leveraging collateral responsibly, borrowers can access financing options that meet their needs while lenders safeguard their investments, fostering a mutually beneficial relationship in the financial landscape. Fostering Mutual Benefit