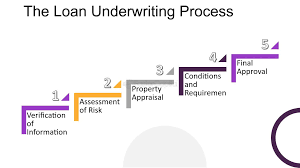

Loan underwriting is a critical step in the lending process that evaluates the creditworthiness and risk of potential borrowers. Here’s a detailed overview of what happens during the loan underwriting process:

Application Review

The process begins when a borrower submits a loan application to a lender. This application typically includes personal information, income details, employment history, and the purpose of the loan. Lenders use this information to assess the borrower’s financial situation and determine their ability to repay the loan.

Credit Check and Verification

One of the primary steps in underwriting is conducting a thorough credit check. Lenders review the borrower’s credit report from major credit bureaus to evaluate their credit score, payment history, outstanding debts, and credit utilization. This information helps lenders assess the borrower’s creditworthiness and determine the level of risk associated with lending to them.

Income and Employment Verification

Lenders verify the borrower’s income and employment details to ensure they have a stable source of income to repay the loan. This may involve requesting pay stubs, tax returns, and employment verification directly from the borrower’s employer. Verification helps lenders confirm the accuracy of the borrower’s financial information provided in the application.

Debt-to-Income Ratio Calculation

Lenders calculate the borrower’s debt-to-income (DTI) ratio, which compares the borrower’s monthly debt payments to their gross monthly income. A lower DTI ratio indicates that the borrower has sufficient income relative to their debt obligations, making them a lower-risk borrower. Lenders typically have maximum DTI ratio thresholds that borrowers must meet to qualify for a loan.

Appraisal and Property Evaluation (For Mortgage Loans)

For mortgage loans, lenders may require an appraisal of the property being purchased or refinanced. An appraisal assesses the property’s market value based on factors such as location, size, condition, and comparable sales in the area. The appraisal helps ensure that the property provides adequate collateral for the loan amount requested.

Risk Assessment and Decision

Based on the information gathered during the underwriting process, lenders conduct a comprehensive risk assessment. They weigh factors such as credit history, income stability, debt obligations, property valuation (if applicable), and overall financial health to make a lending decision. Lenders may approve the loan, deny the application, or request additional information or conditions before finalizing their decision.

Closing and Funding

Once the loan application is approved and all conditions are met, the loan moves to the closing stage. During closing, the borrower signs the loan documents and any required legal disclosures. The lender disburses the funds to the borrower, completing the loan process.

Conclusion

Understanding the loan underwriting process is crucial for borrowers seeking financing, as it involves thorough evaluation of financial factors to determine loan eligibility and terms. By familiarizing yourself with this process, you can better prepare for applying for loans and improve your chances of securing favorable lending terms that meet your financial needs.