Understanding Predatory Lending

Predatory lending refers to unethical practices by lenders that take advantage of borrowers, often through deceptive terms and high fees. Protect yourself from these practices with these proactive steps.

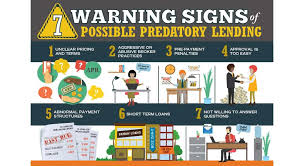

Signs of Predatory Lending

1. High-Pressure Sales Tactics

Be wary of lenders who use aggressive tactics to rush you into signing documents without fully explaining terms or consequences.

2. Unreasonably High Interest Rates

Compare interest rates offered by different lenders. Predatory loans often come with excessively high rates, far above what is reasonable for your creditworthiness.

3. Hidden Fees and Charges

Read the fine print carefully. Predatory lenders may hide fees or inflate costs, making the loan more expensive than initially presented.

4. Balloon Payments

Avoid loans with large balloon payments at the end of the term, as they can lead to financial strain or even default if you’re unable to make the final payment.

5. Negative Amortization

Beware of loans where your monthly payments do not cover the interest due, leading to an increase in the loan balance rather than paying it down.

Tips to Avoid Predatory Lending

1. Research and Compare Lenders

Take time to research lenders and compare offers. Look for reputable institutions with positive reviews and transparent lending practices.

2. Understand Loan Terms

Read all loan documents carefully before signing. Ensure you understand the interest rate, fees, repayment schedule, and consequences of late payments or default.

3. Check for Government Approval

Verify that the lender is licensed and registered with state authorities. Government-approved lenders adhere to regulations designed to protect borrowers from predatory practices.

4. Review Your Credit Report

Know your credit score and history. A good credit score can help you qualify for better loan terms and avoid predatory lenders who target borrowers with poor credit.

5. Seek Financial Counseling

If you’re unsure about loan terms or feel pressured by a lender, seek advice from a financial counselor or trusted advisor. They can provide unbiased guidance to help you make informed decisions.

Conclusion

Avoiding predatory lending practices requires vigilance and careful consideration of loan terms and lender credibility. By educating yourself about the signs of predatory lending, comparing offers, and seeking professional advice when needed, you can protect yourself from financial exploitation and secure loans that align with your financial goals and capabilities. Remember, your financial well-being is paramount, and taking proactive steps can safeguard you from falling victim to predatory lending practices.