When it comes to borrowing money, understanding your options is crucial. Two of the most common forms of credit are loans and lines of credit. Each has distinct features, benefits, and potential drawbacks. Knowing which one is right for you depends on your financial needs and circumstances. This article will help you make an informed decision by comparing loans and lines of credit.

Understanding Loans

A loan is a lump sum of money borrowed from a lender that is paid back over a set period with interest. Loans can be secured or unsecured. Secured loans require collateral, such as a car or home, while unsecured loans do not.

Types of Loans

Personal Loans: These can be used for various purposes, from consolidating debt to funding a vacation. They typically have fixed interest rates and repayment terms.

Mortgage Loans: These are used to purchase a home. They usually have lower interest rates and longer repayment periods, often spanning 15 to 30 years.

Auto Loans: Specifically for purchasing vehicles, auto loans generally offer lower interest rates because the vehicle serves as collateral.

Understanding Lines of Credit

A line of credit provides flexible access to funds up to a certain limit. Unlike loans, you only pay interest on the amount you draw. Once repaid, the credit becomes available again, similar to a credit card.

Types of Lines of Credit

Personal Lines of Credit: These can be used for any purpose, similar to personal loans. They offer flexibility in borrowing and repayment.

Home Equity Lines of Credit (HELOCs): These are secured by the equity in your home. They typically offer lower interest rates and can be used for significant expenses like home renovations or education costs.

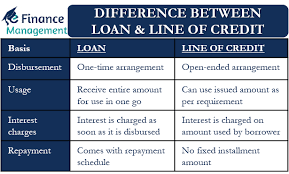

Key Differences

Flexibility and Use

Loan: Provides a fixed amount of money upfront. Ideal for large, one-time expenses like buying a car or funding a major project.

Line of Credit: Offers flexibility to borrow as needed. Suitable for ongoing expenses or emergencies where the exact amount needed is uncertain.

Repayment Terms

Loan: Has a fixed repayment schedule. Payments include both principal and interest, making it easier to budget.

Line of Credit: Offers variable repayment terms. You can pay back the amount borrowed at your own pace, which can be both an advantage and a disadvantage depending on your discipline in managing debt.

Interest Rates

Loan: Generally has a fixed interest rate, providing predictable monthly payments.

Line of Credit: Often has variable interest rates, which can fluctuate over time. This means your monthly payments could vary.

Cost of Borrowing

Loan: The total cost is known upfront. The fixed rate and term make it easier to calculate the total interest paid.

Line of Credit: The cost can be more unpredictable due to variable rates and the flexible borrowing nature. If not managed carefully, it can lead to higher interest costs over time.

When to Choose a Loan

- Large, One-Time Purchases: If you need a substantial sum of money for a specific purpose, a loan is often the better choice.

- Predictable Repayment: Loans are ideal if you prefer fixed monthly payments and a clear end date for your debt.

- Lower Interest Rates: Secured loans, like mortgages and auto loans, typically offer lower interest rates.

When to Choose a Line of Credit

- Ongoing or Uncertain Expenses: If you have fluctuating or ongoing expenses, a line of credit provides the flexibility to borrow as needed.

- Emergency Fund: Having a line of credit can serve as a financial safety net for unexpected expenses.

- Managing Cash Flow: Businesses and individuals who need to manage cash flow can benefit from the flexible nature of a line of credit.

Conclusion

Choosing between a loan and a line of credit depends on your specific financial needs and circumstances. Loans are suitable for large, one-time expenses with predictable repayment schedules. Lines of credit offer flexibility and are ideal for ongoing or uncertain expenses. Understanding these differences will help you make the best decision for your financial situation, ensuring you have the right type of credit to meet your needs.