Personal loans can be a powerful tool for improving your financial health when used wisely. Whether you’re looking to consolidate debt, finance a major purchase, or invest in your future, understanding how to effectively utilize a personal loan can help you achieve your financial goals. This article provides comprehensive insights into how to use a personal loan to enhance your financial well-being.

Understanding Personal Loans

A personal loan is a type of unsecured loan that individuals can borrow from banks, credit unions, or online lenders. Unlike secured loans, personal loans do not require collateral, which means you don’t have to pledge an asset such as a house or car. Personal loans typically come with fixed interest rates and set repayment terms, making them a predictable and manageable option for many borrowers.

Benefits of Personal Loans

Debt Consolidation

One of the most popular uses of personal loans is debt consolidation. If you have multiple high-interest debts, such as credit card balances, you can take out a personal loan to pay off those debts. By consolidating your debt into a single loan with a lower interest rate, you can reduce your monthly payments, simplify your finances, and save money on interest over time.

Lower Interest Rates

Personal loans often offer lower interest rates compared to credit cards and other high-interest debt. If you qualify for a personal loan with a competitive interest rate, you can save money on interest charges, which can help you pay off your debt faster and more efficiently.

Fixed Repayment Schedule

Personal loans come with a fixed repayment schedule, meaning you know exactly how much you need to pay each month and when your loan will be paid off. This predictability can help you budget more effectively and avoid the uncertainty associated with variable-rate loans.

No Collateral Required

Since personal loans are unsecured, you don’t need to provide collateral. This can be advantageous if you don’t want to risk losing an asset or if you don’t have valuable collateral to pledge.

How to Use a Personal Loan Wisely

Evaluate Your Financial Situation

Before taking out a personal loan, it’s essential to evaluate your financial situation. Consider your current debts, income, expenses, and overall financial goals. Understanding your financial standing will help you determine if a personal loan is the right solution for you and how much you can afford to borrow.

Determine the Loan Amount and Purpose

Identify the specific purpose of the loan and determine the loan amount you need. Whether you’re consolidating debt, making a major purchase, or covering an emergency expense, knowing the exact amount will prevent you from borrowing more than necessary and accumulating unnecessary debt.

Shop Around for the Best Rates

Not all personal loans are created equal. Shop around and compare offers from different lenders to find the best interest rates and terms. Online comparison tools and prequalification processes can help you identify the most competitive loan options without impacting your credit score.

Create a Repayment Plan

Once you secure a personal loan, it’s crucial to create a repayment plan. Outline how you will make your monthly payments and ensure that the loan fits within your budget. Sticking to a repayment plan will help you avoid missed payments and potential damage to your credit score.

Use the Loan for Its Intended Purpose

To maximize the benefits of a personal loan, use the funds for their intended purpose. Whether it’s paying off high-interest debt, financing home improvements, or covering medical expenses, using the loan responsibly will help you achieve your financial goals and improve your overall financial health.

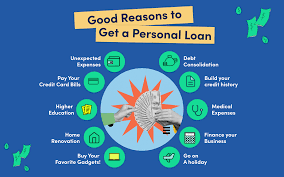

Common Uses of Personal Loans

Debt Consolidation

As mentioned earlier, debt consolidation is a common and effective use of personal loans. By consolidating multiple debts into a single loan, you can streamline your payments, reduce interest costs, and potentially pay off your debt faster.

Home Improvements

Personal loans can be used to finance home improvements, which can increase the value of your property and improve your living conditions. Whether you’re renovating your kitchen, adding a new bathroom, or making energy-efficient upgrades, a personal loan can provide the necessary funds.

Medical Expenses

Unexpected medical expenses can be financially burdensome. Personal loans can help cover medical bills, surgeries, or other healthcare-related costs, providing you with the financial support needed during challenging times.

Major Purchases

If you need to make a major purchase, such as buying new furniture, appliances, or a vehicle, a personal loan can be a practical financing option. By spreading the cost over a fixed repayment period, you can manage your expenses more effectively.

Emergency Fund

Building an emergency fund is essential for financial stability. If you don’t have sufficient savings, a personal loan can serve as a temporary solution to cover unexpected expenses, such as car repairs or urgent home maintenance.

Potential Risks and How to Mitigate Them

Overborrowing

One of the risks of personal loans is overborrowing. Borrowing more than you need can lead to unnecessary debt and financial strain. To avoid this, carefully assess the loan amount required and resist the temptation to borrow extra funds.

High Interest Rates for Poor Credit

If you have a poor credit score, you may be offered high interest rates on personal loans. To mitigate this, work on improving your credit score before applying for a loan, or consider finding a cosigner with good credit to secure better terms.

Increased Debt Load

Taking out a personal loan adds to your overall debt load. It’s crucial to ensure that you can comfortably manage the additional monthly payments without compromising your financial stability. Evaluate your budget and make necessary adjustments to accommodate the loan repayment.

Conclusion

In conclusion, a personal loan can be a valuable tool for improving your financial health when used responsibly. By consolidating debt, financing major expenses, or covering emergencies, personal loans offer flexibility and predictability. However, it’s essential to evaluate your financial situation, compare loan offers, and create a solid repayment plan to maximize the benefits and avoid potential pitfalls. With careful planning and disciplined use, a personal loan can help you achieve your financial goals and enhance your overall financial well-being.