Secured vs. Unsecured Loans: Which is Right for You?

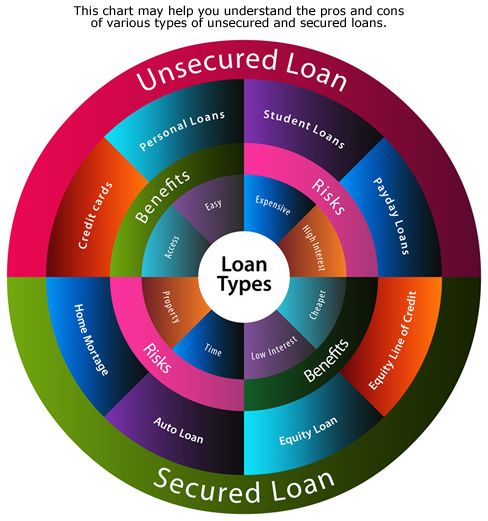

When considering taking out a loan, understanding the differences between secured and unsecured loans is crucial. Each type of loan has distinct characteristics, benefits, and risks that can impact your financial situation. This article will help you understand the key differences between secured and unsecured loans and guide you in choosing the one that best suits your needs.

What Are Secured Loans?

Secured loans are loans that are backed by collateral. Collateral is an asset that you pledge to the lender as security for the loan. Common types of collateral include homes, cars, savings accounts, or other valuable assets. If you default on the loan, the lender has the right to seize the collateral to recoup their losses.

Examples of Secured Loans:

- Mortgage Loans: Secured by the property being purchased.

- Auto Loans: Secured by the vehicle being financed.

- Home Equity Loans and Lines of Credit (HELOCs): Secured by the borrower’s home equity.

- Secured Personal Loans: Can be secured by various assets, such as savings accounts or certificates of deposit (CDs).

What Are Unsecured Loans?

Unsecured loans do not require collateral. Approval and terms are based primarily on your creditworthiness, income, and other financial factors. Because there is no asset backing the loan, lenders typically consider unsecured loans to be riskier, which can result in higher interest rates and stricter approval criteria.

Examples of Unsecured Loans:

- Personal Loans: Can be used for various purposes, such as debt consolidation, medical expenses, or home improvements.

- Credit Cards: Revolving lines of credit that can be used for everyday purchases.

- Student Loans: Used to finance education costs.

- Unsecured Lines of Credit: Similar to credit cards but typically with lower interest rates and higher credit limits.

Pros and Cons of Secured Loans

Pros:

- Lower Interest Rates: Because secured loans are backed by collateral, they typically have lower interest rates compared to unsecured loans.

- Higher Borrowing Limits: Lenders may offer larger loan amounts due to the reduced risk.

- Easier Approval: Borrowers with less-than-perfect credit may find it easier to qualify for secured loans.

Cons:

- Risk of Asset Loss: If you default on a secured loan, you risk losing the asset you pledged as collateral.

- Longer Processing Times: Secured loans, especially mortgages, can take longer to process due to the appraisal and documentation requirements.

Pros and Cons of Unsecured Loans

Pros:

- No Collateral Required: You don’t need to pledge any assets to secure the loan, reducing the risk of losing personal property.

- Faster Approval: Unsecured loans often have quicker approval processes, as there’s no need for collateral evaluation.

- Flexible Use: Unsecured loans can be used for a wide range of purposes without restrictions.

Cons:

- Higher Interest Rates: Because they are riskier for lenders, unsecured loans generally come with higher interest rates.

- Stricter Approval Criteria: Lenders often require good to excellent credit scores and strong financial histories.

- Lower Borrowing Limits: Unsecured loans typically offer lower borrowing amounts compared to secured loans.

Choosing the Right Loan for You

When deciding between a secured and unsecured loan, consider the following factors:

- Purpose of the Loan: What do you need the loan for? If you’re purchasing a home or car, a secured loan is likely necessary. For other purposes, such as debt consolidation or covering unexpected expenses, an unsecured loan might be more appropriate.

- Credit Score and Financial Situation: If you have a strong credit score and stable income, you may qualify for favorable terms on either type of loan. If your credit is less than stellar, a secured loan might be easier to obtain.

- Risk Tolerance: Are you comfortable risking an asset as collateral? If you prefer not to put any of your property at risk, an unsecured loan would be a better choice.

- Interest Rates and Costs: Compare the interest rates, fees, and overall costs of both loan types. Secured loans typically offer lower rates, but consider the potential cost of losing your collateral.

- Loan Amount and Term: Determine how much you need to borrow and how long you’ll need to repay it. Secured loans often offer higher borrowing limits and longer repayment terms.

- Approval Speed: If you need funds quickly, an unsecured loan might be the better option due to its faster approval process.

Conclusion

Secured and unsecured loans each have their own advantages and disadvantages. Secured loans offer lower interest rates and higher borrowing limits but come with the risk of losing your collateral. Unsecured loans provide flexibility and quicker access to funds but often have higher interest rates and stricter approval criteria. By carefully considering your financial situation, needs, and risk tolerance, you can choose the loan type that best aligns with your goals and circumstances. Always compare offers from multiple lenders to ensure you get the best terms available.