In the realm of personal and business finance, loan agreements are essential documents that outline the terms and conditions of borrowing. These agreements are legally binding contracts between the lender and the borrower, and they carry significant implications for your financial future. Despite their importance, many people do not read loan agreements thoroughly before signing. This article delves into the critical reasons why reading loan agreements carefully is paramount.

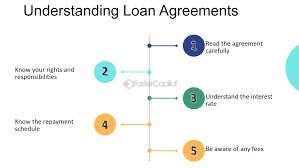

Understanding Loan Agreements

A loan agreement is a detailed document that specifies the terms of the loan, including the amount borrowed, interest rate, repayment schedule, fees, and any other conditions or requirements set by the lender. It serves as a formal record of the loan transaction and protects the interests of both parties.

Key Elements of a Loan Agreement

Principal Amount

The principal amount is the sum of money borrowed. It is crucial to verify that this amount matches what you have agreed upon with the lender.

Interest Rate

The interest rate determines the cost of borrowing. This can be a fixed rate, which remains constant throughout the loan term, or a variable rate, which can change based on market conditions. Understanding how the interest rate affects your monthly payments and the total cost of the loan is vital.

Repayment Schedule

The repayment schedule outlines how and when you will repay the loan. This includes the frequency of payments (monthly, quarterly, etc.) and the duration of the loan. Ensure that the repayment terms are manageable within your budget.

Fees and Penalties

Loan agreements often include various fees and penalties, such as origination fees, late payment fees, and prepayment penalties. These costs can add up and impact the overall affordability of the loan. It is essential to be aware of all potential charges.

Collateral Requirements

If the loan is secured, the agreement will specify the collateral required, such as property or assets. Understanding the implications of providing collateral and the conditions under which the lender can seize it is crucial.

Default Conditions

The agreement will define what constitutes a default and the consequences of failing to meet your obligations. This can include legal actions, additional fees, and damage to your credit score.

Why Reading Loan Agreements Carefully Matters

Avoiding Hidden Costs

One of the primary reasons to read loan agreements carefully is to avoid hidden costs. Lenders may include fees or charges that are not immediately apparent. By thoroughly reviewing the agreement, you can identify these costs and avoid unexpected financial burdens.

Understanding Your Obligations

A loan agreement details your responsibilities as a borrower. Understanding your obligations ensures that you can meet them and avoid default. This includes knowing the payment schedule, required documentation, and any conditions you must fulfill.

Protecting Your Rights

Loan agreements also outline your rights as a borrower. This includes information about grace periods, the process for disputing charges, and your right to prepay the loan without penalty. Being aware of your rights can help you protect your interests.

Avoiding Legal Consequences

Failing to comply with the terms of a loan agreement can result in legal consequences. This can include lawsuits, wage garnishment, and damage to your credit score. By understanding the agreement, you can avoid actions that might lead to legal trouble.

Making Informed Decisions

Thoroughly reading a loan agreement enables you to make informed decisions about borrowing. You can compare different loan offers, understand the long-term implications, and choose the option that best aligns with your financial goals and capabilities.

Tips for Reading Loan Agreements

Take Your Time

Do not rush through a loan agreement. Take your time to read and understand each section. If possible, review the document over several days to ensure you do not miss any critical details.

Seek Clarification

If there are terms or clauses that you do not understand, seek clarification from the lender. Do not hesitate to ask questions or request explanations in writing. Understanding every aspect of the agreement is essential.

Consult a Professional

Consider consulting a financial advisor or attorney if you are unsure about any part of the agreement. A professional can provide valuable insights and help you identify potential red flags.

Compare with Other Offers

Compare the loan agreement with offers from other lenders. This can help you identify competitive terms and ensure that you are getting the best deal possible.

Focus on Key Terms

Pay special attention to the key terms of the agreement, such as the interest rate, repayment schedule, fees, and default conditions. These terms have the most significant impact on your financial obligations.

Common Pitfalls to Avoid

Ignoring Fine Print

The fine print often contains crucial information about fees, penalties, and conditions. Ignoring these details can lead to unpleasant surprises. Ensure you read every part of the agreement, including the fine print.

Overlooking Variable Interest Rates

Variable interest rates can change over time, potentially increasing your monthly payments. Ensure you understand how variable rates are determined and the maximum rate you could be charged.

Failing to Consider Total Cost

Focus on the total cost of the loan, not just the monthly payments. This includes all interest, fees, and charges over the life of the loan. Understanding the total cost helps you evaluate the loan’s affordability.

Assuming Flexibility

Do not assume that the lender will be flexible with payment terms. Loan agreements are legally binding, and lenders are not obligated to make concessions. Ensure the terms are acceptable before signing.

Conclusion

Reading loan agreements carefully is a crucial step in protecting your financial health and making informed borrowing decisions. By understanding the terms and conditions, you can avoid hidden costs, fulfill your obligations, protect your rights, and avoid legal consequences. Taking the time to thoroughly review and understand a loan agreement empowers you to make the best financial choices for your future.