Understanding Personal Lines of Credit

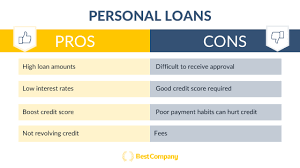

A personal line of credit offers flexible borrowing options similar to a credit card but typically with lower interest rates. Here’s a detailed look at its advantages and disadvantages.

Pros of Personal Lines of Credit

1. Flexibility in Borrowing

Personal lines of credit provide flexibility as you can borrow funds as needed up to a predetermined limit. This gives you control over how much you borrow and when.

2. Lower Interest Rates

Compared to credit cards, personal lines of credit often come with lower interest rates, especially if you have a good credit score. This can save you money on interest payments.

3. Access to Cash Flow

It serves as a safety net for unexpected expenses or cash flow gaps in your personal finances, offering immediate access to funds without the need for a new loan application.

4. Build Credit History

Responsible use of a personal line of credit can help you build a positive credit history, demonstrating your ability to manage credit and potentially improving your credit score over time.

5. Pay Interest Only on What You Use

You only accrue interest on the amount of credit you actually use, not on the entire credit limit available, which can lead to cost savings if you borrow responsibly.

Cons of Personal Lines of Credit

1. Variable Interest Rates

Unlike personal loans with fixed rates, lines of credit often come with variable interest rates, which means your monthly payments can fluctuate based on market conditions.

2. Temptation to Overspend

The flexibility of a line of credit can lead to overspending or borrowing more than you can comfortably repay, potentially putting you in debt if not managed carefully.

3. Fees and Charges

Some personal lines of credit may involve annual fees or maintenance fees, reducing the overall cost-effectiveness compared to other borrowing options.

4. Potential for Credit Score Impact

Missed payments or carrying high balances relative to your credit limit can negatively impact your credit score, affecting future borrowing capabilities and interest rates.

5. Risk of Collateral Requirement

Depending on the lender and your creditworthiness, securing a personal line of credit may require collateral, such as a savings account or a certificate of deposit.

Conclusion

In conclusion, personal lines of credit offer flexibility and financial security for those who manage their finances responsibly. However, they also come with risks, including variable interest rates and potential overspending. Before opting for a personal line of credit, carefully consider your financial situation, borrowing needs, and ability to repay to make an informed decision that aligns with your long-term financial goals.