Introduction to Loan Repayment Terms

Understanding loan repayment terms is essential for anyone considering borrowing money. Repayment terms dictate how and when you will pay back the borrowed amount. These terms can significantly impact your financial health and overall borrowing experience.

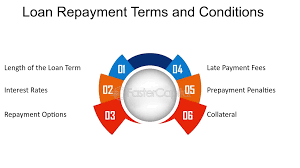

Key Components of Loan Repayment Terms

Loan repayment terms consist of several key components. These include the loan amount, interest rate, repayment schedule, and loan duration. Each component plays a crucial role in determining the total cost of the loan and the monthly payments you will make.

Interest Rates and Their Impact

Interest rates are a critical part of loan repayment terms. They determine the cost of borrowing money. Fixed interest rates remain constant throughout the loan term, providing stability in monthly payments. Variable interest rates can fluctuate, leading to changes in payment amounts over time.

Understanding Repayment Schedules

Repayment schedules outline how often you need to make payments. Common schedules include monthly, bi-weekly, and weekly payments. Understanding your repayment schedule is crucial for budgeting and ensuring you make timely payments.

Loan Duration and Its Effects

The duration of a loan, or the loan term, affects both the monthly payments and the total interest paid. Shorter loan terms generally result in higher monthly payments but lower overall interest costs. Longer loan terms have lower monthly payments but higher total interest costs.

The Importance of Amortization

Amortization refers to the process of gradually paying off a loan through regular payments. Each payment covers both interest and a portion of the principal amount. Amortization schedules help borrowers understand how their payments are applied and how the loan balance decreases over time.

Early Repayment and Prepayment Penalties

Many loans offer the option of early repayment. However, some loans may include prepayment penalties. These penalties are fees charged for paying off the loan before the agreed-upon term. Understanding these terms is crucial to avoid unexpected costs if you plan to repay your loan early.

Grace Periods and Their Benefits

A grace period is the time after the loan disbursement during which no payments are required. This period allows borrowers to get financially settled before starting repayments. Knowing if your loan includes a grace period can help you plan your finances better.

The Role of Loan Covenants

Loan covenants are conditions set by the lender to ensure the borrower’s financial stability. These conditions may include maintaining a certain level of income or restricting additional borrowing. Understanding these covenants is essential to avoid breaching loan terms and facing penalties.

Tips for Managing Loan Repayments

Effective loan management involves understanding your repayment terms and budgeting accordingly. Set reminders for payment due dates to avoid late fees. If possible, consider making extra payments to reduce the principal amount faster and save on interest.

Conclusion

Understanding loan repayment terms is crucial for managing your finances effectively. By comprehending interest rates, repayment schedules, loan duration, and other key components, borrowers can make informed decisions. Properly managing loan repayments ensures a smoother borrowing experience and helps maintain financial health.