Introduction to Auto Loan Refinancing

Refinancing your auto loan can be a strategic move to save money or adjust your financial situation. Here are key factors to consider before making this decision.

Benefits of Auto Loan Refinancing

1. Lower Interest Rates

Refinancing allows you to secure a new loan with a lower interest rate than your current auto loan, potentially reducing your monthly payments and overall interest costs.

2. Improved Loan Terms

You can extend or shorten the loan term through refinancing, adjusting your repayment schedule to better fit your financial goals and current budget.

3. Access to Cash

Some refinancing options allow you to borrow additional funds against the equity in your vehicle, providing extra cash for other expenses or debt consolidation.

4. Change in Lender Terms

Switching to a new lender through refinancing may offer better customer service, online account management options, or more favorable terms and conditions.

Considerations Before Refinancing

1. Current Loan Status

Evaluate the remaining balance on your current auto loan and compare it with the vehicle’s current market value to determine if refinancing makes financial sense.

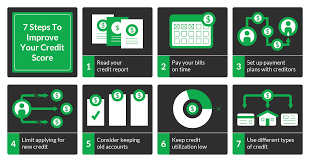

2. Credit Score

Your credit score plays a crucial role in the interest rate you qualify for when refinancing. A higher credit score generally leads to lower interest rates and better loan terms.

3. Fees and Charges

Consider any fees associated with refinancing, such as application fees, title transfer fees, or prepayment penalties on your current loan. Calculate these costs to ensure they don’t outweigh potential savings.

4. Impact on Monthly Payments

While refinancing can lower your monthly payments by extending the loan term, be mindful that extending too much may result in paying more interest over the life of the loan.

5. Loan Term and Equity

Determine the optimal loan term that balances monthly affordability with interest savings. Additionally, assess the equity in your vehicle to leverage it for cash-out refinancing if needed.

Conclusion

Refinancing your auto loan can be a strategic financial decision to lower costs, adjust loan terms, or access cash for other needs. Before proceeding, assess your current loan status, credit score, fees involved, and the potential impact on monthly payments. By carefully considering these factors and comparing offers from different lenders, you can make an informed choice that aligns with your financial goals and improves your overall financial health.